does cash app affect taxes

However in Jan. Cash App Taxes makes no guarantee over when refunds are sent by the IRS or states and funds can be made available.

Is The Cash App Safe For Tax Returns As Usa

Of course having to pay taxes on income through cash apps is.

. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. 2022 the rule changed. Reporting Cash App Income.

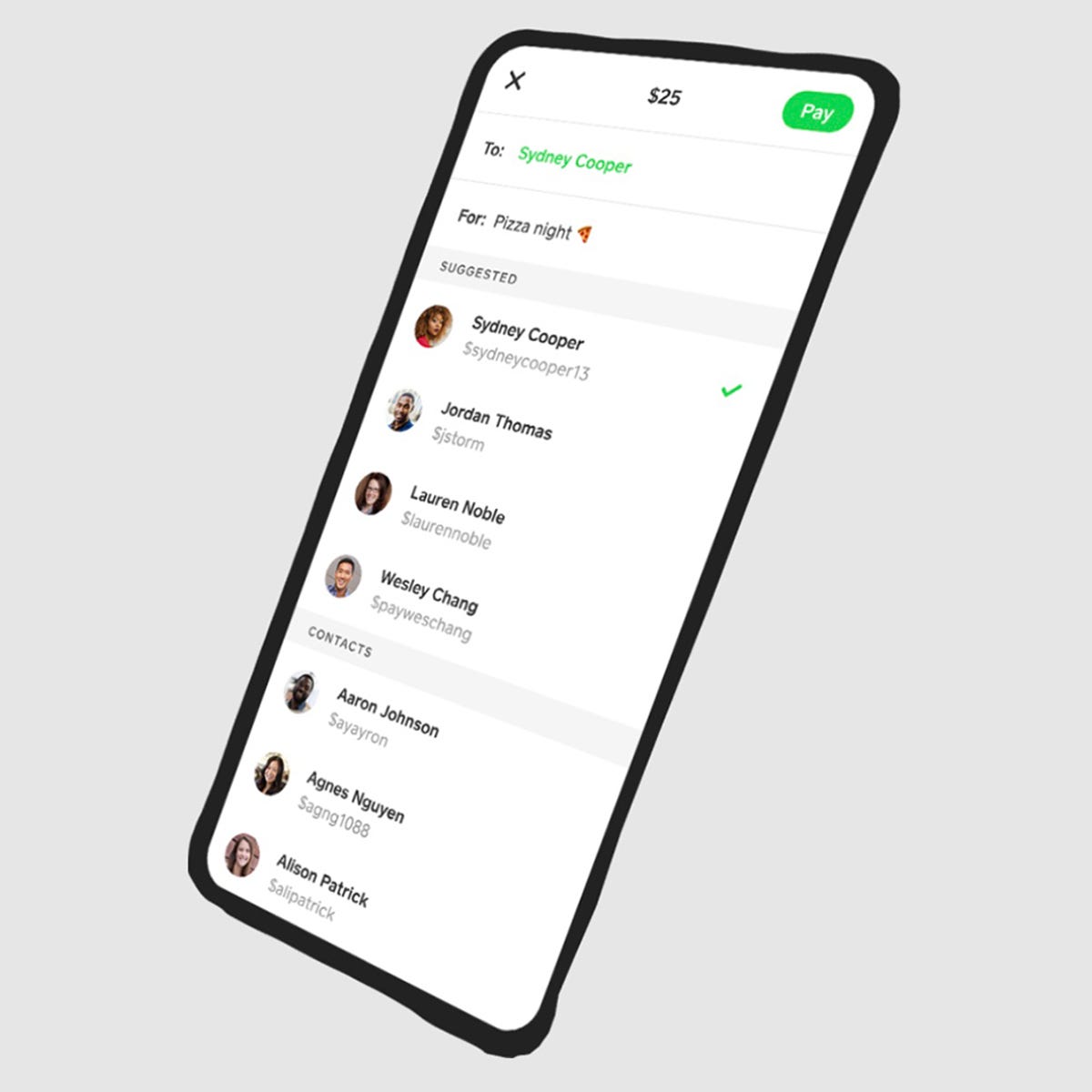

If you have a standard Cash App account no. Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they exceed 600. With this service Cash App is quickly becoming a one-stop shop for financial services.

If you receive over 600 in yearly income on Venmo Cash App Zelle or PayPal you will receive a Form 1099-K. If you are using Cash App for receiving tax refunds government unemployment checks and paychecks you should be aware of the issues. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the.

Sadly these changes are projected to affect rental business owners. Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS. 1040 schedule C sole proprietorship.

5 day refund estimate is based on filing data from 2020. The IRS is changing their rules regarding Cash Apps and services like PayPal. Users with Cash App for Business accounts that accept over 20000 and more than 200 payments per year will receive a 1099-K tax form.

Cash App Transactions That Are Not Taxed. If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. With Cash App Taxes formerly Credit Karma Tax users can file their taxes for no charge.

Not all cash app transactions are taxed. Cash App does not provide tax advice. If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year.

Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle. Reporting Cash App Income. This states that if while filing an amended federal tax return via another online tax service you find that you receive a greater refund value or owe less in federal taxes you can.

You can use Cash App Taxes to file your individual forms to report income or loss from a small business or other partnership including. If youre an owner who is accepting. If you have an upgraded Cash for Business account Cash App will only file a Form 1099-K if your business has 600 or more in gross sales in the.

Some states require 1099-K forms for. Transactions that can be excluded from income include certain kinds of P2P payments as well.

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

A Cash App Con That Could Wipe Out Your Bank Account Wric Abc 8news

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

What Is Cash App And How Does It Work Zdnet

Getting Paid On Venmo Or Cash App There S A Tax For That Los Angeles Times

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Cash App Income Is Taxable Irs Changes Rules In 2022 Chosen Payments

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

Cash App Taxes 100 Free Tax Filing For Federal State

Tax Changes Coming For Cash App Transactions

Credit Karma Tax Is Now Cash App Taxes Forbes Advisor

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Irs Tax Season 2022 Starts Monday And Ends April 18 For Most States

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

Cash App Taxes Review 2022 Formerly Credit Karma Tax

How To Send Money On Cash App Without A Debit Card